How are you going to start off in 2020?

Improving personal finances is always in the top five New Year’s resolutions, according to research.

But 2020 isn’t only the start of a new year, it’s the start of a new decade. And while I encourage goal setting, especially in the personal finance arena, I have a challenge for you: Take the long view and set a 10-year goal.

Most people overestimate what they can do in one year, and underestimate what they can do in ten years.

Bill Gates

I love this quote, and as a financial advisor, I see the situation a lot. I mean, who doesn’t want to become debt-free, amass millions, and retire to an island within the next 12 months? But thinking about 10 or 20 years from now isn’t always a focus.

If you are determined to be a financial success in this new decade, you will benefit from taking the steps I’m about to share with you. I hope to help you become more aware and intentional with your finances. By being more aware, you can make the most of your income over the next 10 years (and think how much of a difference that will make for retirement! To meet your life goals! For your kids!).

You don’t want to look back on Dec. 31, 2029 wondering why you aren’t where you thought you’d be. You’ve earned in the millions (yes, millions), but what if in 10 years you don’t have much to show for it besides material possessions or “assets” that don’t put money in your pocket? You want things to look different than that, right? Well, let’s make sure of that.

Step 1: Complete a net worth reflection exercise.

How much did you earn in total from 2010 through 2019?

This might seem like an intimidating question, especially because most of us aren’t great at keeping accurate financial records. At least not 10 years worth of pay-stubs and W2s, right?

Don’t fret! We all have a “business partner” who is great at keeping score. I mean, how else would he get his cut of our earnings if he’s not counting? That’s right! You may have guessed that Good O’l Uncle Sam is our business partner, and believe it or not, he’s been collecting receipts of what we’ve earned over our working lives.

Visit the Social Security website to register for an account and get a copy of your earnings statement. In this statement, you’ll see exactly what you’ve earned on the record all the way back to your very first job.

Don’t get distracted, remember that we are doing a 10 year look-back to see how much money you earned during this last decade. On Page 3 of your statement, you will see “Your Earnings Record.”

You’ll find two columns on this page: The first is earnings that were taxed with regular social security (which has a cap) and the second is your earnings that were taxed for Medicare, which has no such cap. If your two columns don’t have the same number for each year, use the higher numbers in the second column. If you earn a high income like many of my clients, you should tally up the numbers in the second column that’s titled “Your Taxed Medicare Earnings.” Add up the yearly totals from 2010 to 2018, then estimate your gross income for 2019 by looking at your most recent pay stub and add it in. If you are doing this exercise in 2020, you should be able to see your 2019 number in the column, too.

You should have a 10-year earnings total now. Eye opening, isn’t it? Can you believe you’ve cumulatively earned $750k, $1M, $2M, maybe more in the last 10 years? If you have a working spouse, be sure to help them do this exercise as well. I do this exercise with my clients and many of them can’t believe they’ve earned so much. They may look around and not feel rich or feel that their finances have improved that much in the past decade.

Note: If you received an inheritance or non-work related windfall during this time period, add it to your income number since its impact is likely reflected in your net worth.

By how much did your net worth grow in those ten years?

Net worth is a general measure of financial wealth. To identify your net worth, use this simple formula: take everything you own (assets), then subtract what you owe (liabilities or debt). The number you derive, whether positive or negative, is your net worth.

If your net worth is a negative number, that means you have more debt than you have assets. The younger a person is, the higher the likelihood of a negative net worth, especially if they have student loans. As you get older and if you’ve been earning income for awhile, your net worth should start trending in the other direction, toward positive numbers. This will only happen if you are reducing debt as well as saving/investing with your surplus income.

To find out how much your net worth has grown in the past decade, follow this strategy:

1. Calculate your beginning net worth

This might be a lot harder to estimate but you should try to ballpark a number. Think back to the beginning of 2010: How old were you? What did you own (assets) and what you owe (debt)? Subtract your debt from your assets and you have your starting net worth.

2. Calculate your current net worth

This should be a lot easier to do since you are focusing on present day assets and present day debts.

3. Tally the difference

Now, subtract your beginning net worth from the current net worth.

4. Reflect on your “growth” number:

By how much did your net-worth grow? If you like numbers, you can also calculate what percentage of growth your net worth experienced in that time.

What gets measured can be improved.

Unknown

Step 2: Get honest with yourself

How well did you do in using your income (earnings) to build wealth?

For the sake of illustration, let’s assume you earned $1,000,000 cumulatively over the last 10 years. Now, let’s assume the “growth” number you calculated was $100,000. You can use those numbers to calculate what percentage of your income you retained for the future or used to boost your wealth

Take the $100,000 of “growth” and divide by the $1,000,000 of income = 10 percent

Let’s call that 10 percent your personal wealth retention ratio.

How do you feel about your number? Does it make you proud or does it make you feel you could be more intentional about building wealth?

Now, understand that I don’t expect you to have a ridiculously high wealth-retention ratio. Let’s assume one-third of your earnings will go to taxes and benefits, then you have discretion over the remaining two-thirds of your earnings. You have a choice on what you do with what’s left. You decide on how much you spend on housing, transportation, eating out, and entertainment. These choices can eat up the full two-thirds of the earnings you control, or you can intentionally leave yourself room to save and invest for the future.

So, are you being deliberate about how much of your income you are saving and investing for the future? Are you engaging in wealth-building financial behaviors? Do you want to see that net worth number grow over time? What kind of difference would it make in your life, in the lives of your children or family members, or in the impact of your favorite charities?

Write down your answers to these questions as you reflect.

Step 3: Set goals and go be intentional

How much are you projected to make over the next 10 years?

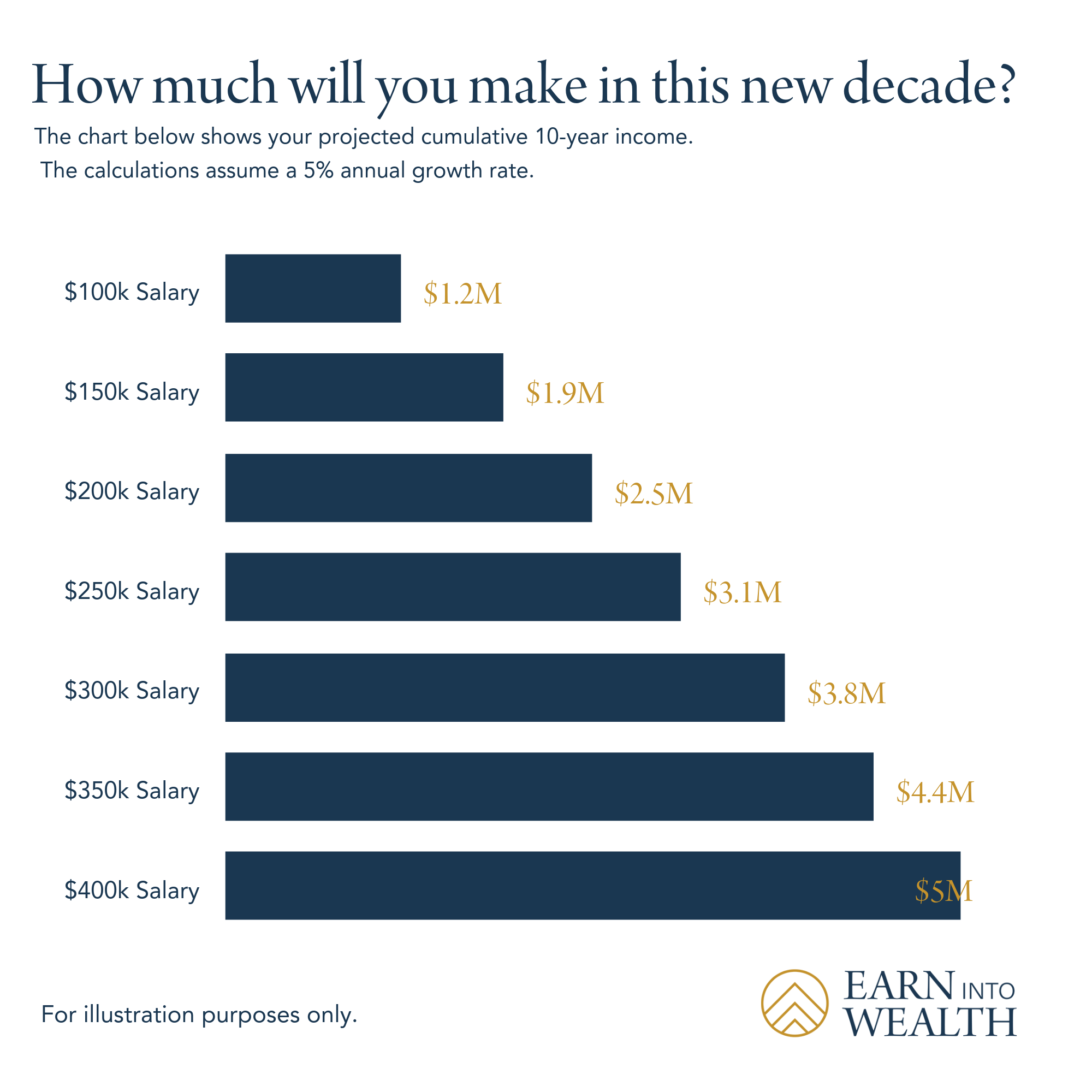

To help visualize how to apply your personal wealth retention ratio and how it could make a major impact on your life and your future, let’s review an example. The chart below shows total 10-year income, glimpsed at different income levels. The numbers assume a simplistic growth rate of 5 percent, meaning income is growing by that much each year. While it is rare for income to grow in a straight line, because of course job changes, promotions, and layoffs do happen, let’s keep things simple for the purpose of this projection exercise.

Take a look at the chart and pinpoint where your income falls. Once you know what you project to earn over the next 10 years, hold on to that number as we keep moving to set your goals.

How much of this income do you intend to keep for yourself?

Assuming you have complete discretion over two-thirds of your earnings, how much will you spend on living in the present, and how much will you invest for the future?

To use a salary example from the chart above, if you begin with a starting salary of $150k you’ll earn $1.9M, and have discretion over $1.2M during that time-frame.

Now decide what you want to have left. Some of those costs may be fixed at the moment, such as a mortgage on property you own or lingering debt from school or spending. But as time goes on, you can take into consideration the discretionary choices you make: luxury cars, electronics, or clothing, or more mid-range prices? Do you prefer to spend earnings on travel, or entertainment, and how do you make wise choices in those and other categories of your spending?

It comes down to asking yourself this question: What amount or percentage will go toward growing your wealth and increasing your net worth? Growing your wealth will take your earnings well into the future – making them work for you long after an in-the-moment purchase or idea.

Once you have your percentage or amount of earnings you’d like to invest in growing your wealth, it’s time to move on to the next conversation.

How will you execute on this goal?

A goal without a plan is just a wish.

Antoine De Saint-Exupéry

To improve your net worth, you can grow your assets or reduce your debt. Or, you can do both. I always recommend trying to both at the same time. If you focus only on paying off debt, you may find yourself losing out on an enormous return on your investments you could have earned – the earlier you begin to save and invest, the more impact it will have. Conversely, if you focus solely on investing and not paying down debt, you may find your debts limit your current and future choices. In addition to these considerations, you have to pay attention to not losing what you’ve earned. You’ll need some wealth protection as well; decreasing risk and protecting your earnings is a big piece of the puzzle.

Some asset growing activities you could pursue:

- Funding your retirement accounts

- Improving your skill set to earn more income

- Investing in the stock market

- Starting or growing your business

- Buying investment property

- Buying appreciating real-estate

Some steps you could take to reduce your debt:

- Living within your means/using a budget

- Putting away your credit cards

- Refinancing expensive debt to lower interest rates

- Borrowing less than you can afford on a car, a house, or other large purchase

To protect your assets, some actions you can focus on include:

- Carrying adequate insurance policies on yourself, your property, and your business

- Having an adequate emergency fund

- Staying valuable on the job

- Living a healthy lifestyle

The Next Steps

We’ve walked through discovering the value of your earnings over time, calculating the growth (or decline) in your net worth, and some strategies for continuing to build your net worth and protect your future. If you’ve defined a goal to grow your wealth, I encourage you to come up with a concrete plan to accomplish that (and I’m happy to help!).

I hope this was a helpful exercise for you. People don’t become millionaires or multi-millionaires by accident. It takes intention, dedication, prioritizing, and planning. I wish you a financially fruitful decade ahead!

Do you need help creating a financial plan for the decade ahead? Please reach out at or you can skip ahead by scheduling a consultation.

This information is not intended to be a substitute for specific individual tax or legal advice. The article is for general informational purposes only. Reproduction of this material is not permitted without written permission.